Revenue Payroll Return & Payment Due Dates

The introduction of PAYE modernisation in January 2019 has eliminated the need for P30 and P35 returns to Revenue. Reporting to Revenue is now in real-time at the end of each weekly/monthly payroll run, using a payroll submission report (PSR).

Monthly Statement

Each month, the Revenue will issue a monthly statement based on your submissions by the 5th day of the following month showing a summary of the liability for:

- Income Tax

- Universal Social Charge

- Pay Related Social Insurance

- Local Property Tax.

The monthly statement will be available from 5th of the following month and you will have the option to:

- view the statement

- accept the statement

- amend your payroll submission (if you identify errors).

If no amendments or corrections are made before 14th of the following month, then the statement will automatically be deemed as your return by the 14th.

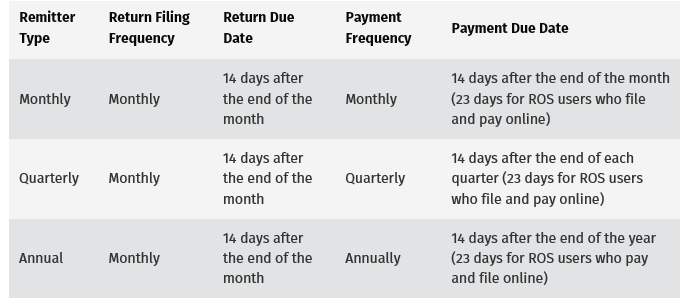

Payment Due Dates

Quarterly and annual remitters will:

- have a monthly statement issued by Revenue, which becomes their monthly return

- file monthly returns, but the payment due date will not change.

Return & Payment Due Dates

- If you avail of the direct debit scheme, you must ensure that the cumulative monthly payments are sufficient to cover the annual liability.

- A variable direct debit scheme has also been introduced. This works differently to the fixed direct debit scheme. Instead of requesting a fixed amount from your bank account each month, we will get permission to request the value of your monthly liability.

How to make a payment using Statement of Account

If you need any further information please email primary@fssu.ie or phone (01) 9104020.